My Investment Framework: What makes an Exceptional Value Stock?

What to look for to get high returns.

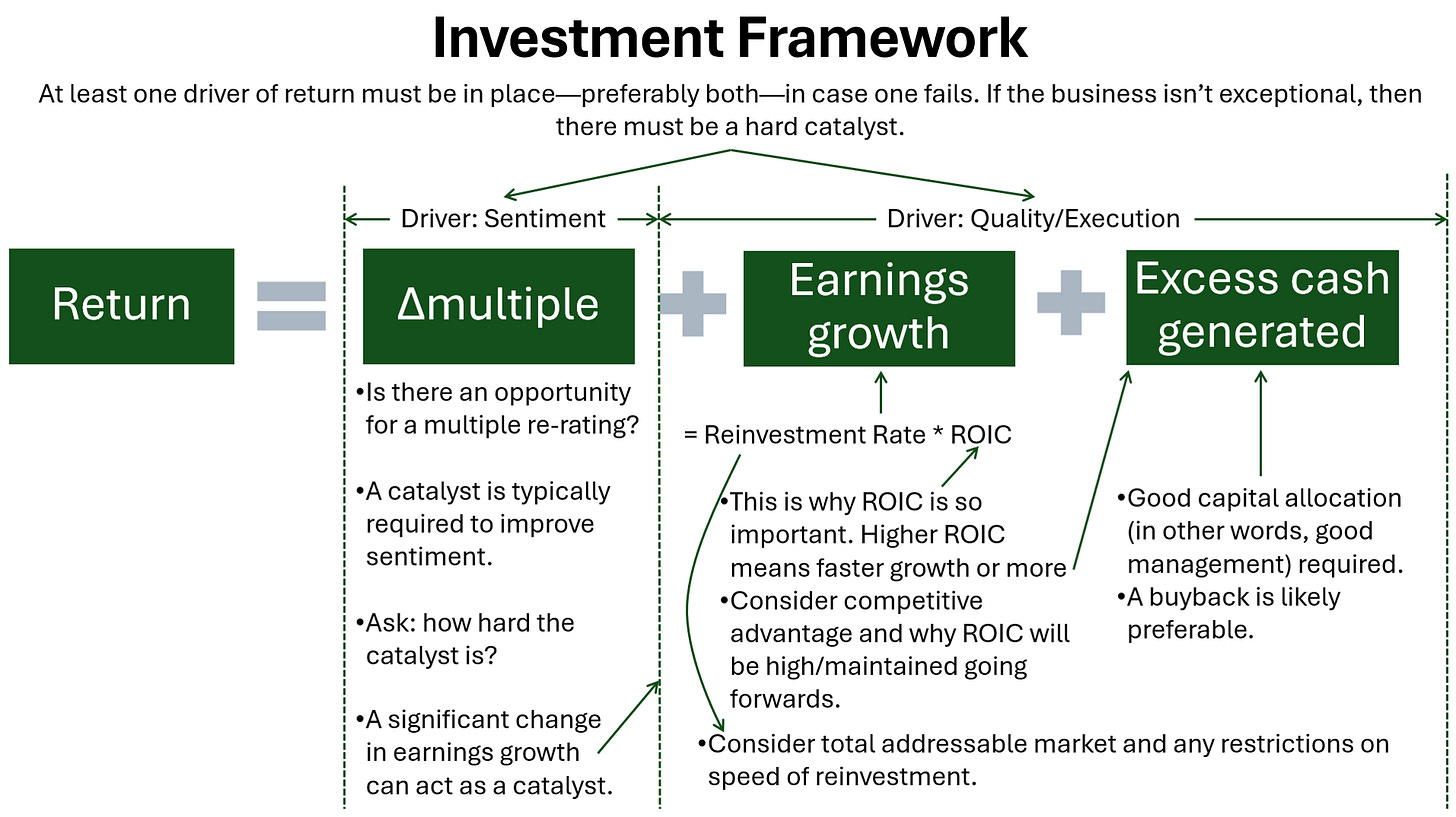

In this post, I share the framework I use to identify Exceptional Value Stocks—those that offer high returns by considering business quality, management execution, and market sentiment. (Note: I won’t go into portfolio management or risk here—those may warrant a future post). While there’s no rocket science here, the goal is to bring clarity of thought when choosing between or excluding opportunities.

After laying out the framework, I’ll discuss how previously highlighted stocks align—or not—with these criteria. If you think my framework is missing something, I’d love to hear your thoughts.

Investment Framework

Here is the framework in full:

Fundamentally, stock returns come from three sources: earnings growth, excess cash generation, and increases in valuation multiple. Earnings growth and excess cash generated are closely related, whereas changes in the multiple can be related to these components but can also be independent. Therefore, I separate my framework into two return drivers: Quality/Execution and Sentiment.

Sentiment

I will start by expanding on sentiment as it is the simplest of the two drivers. Improving sentiment leads to a higher valuation multiple. It should be asked if there is an opportunity for a multiple re-rating. If the multiple is high then it may be foolish to expect the multiple to increase. If the multiple is unjustifiably low then there is an opportunity for a multiple re-rating.

The next question is: what could trigger an improvement in sentiment? A catalyst increases the odds of a re-rating. The harder the catalyst, the better.

A significant change in the Quality/Execution driver will of course act as a catalyst and increase the multiple.

Quality/Execution

Earnings growth of a company is a component of returns. Earnings growth = reinvestment rate * return on invested capital (ROIC).

The greater the opportunity to reinvest the greater the growth and so it should be considered what is the total addressable market (TAM) for the company and if there are any restrictions on the speed of reinvestment.

ROIC is one of the most important components to the value of a company. High ROIC means the company will be able to grow faster and may even possibly generate excess cash whilst doing so. This is why high ROIC businesses deserve a higher multiple. One of the most critical questions in business analysis is whether a company can sustain or achieve high ROIC over time due to competitive advantages.

Finally, if the company is generating excess cash, how is management allocating it? Are shareholders going to see it or will it be squandered. If the business is at a modest multiple then using the cash to buy back shares is likely preferable.

To Sum Up

While it’s not essential to have both drivers—Quality/Execution and Sentiment—in place, having both strengthens the investment case. For instance, if a catalyst fails to lift sentiment, returns can still come from earnings growth and excess cash generation. Conversely, if growth falls short, a low entry multiple paired with a strong catalyst may still drive returns.

At a minimum, one of the two drivers must be present. Since I run a concentrated portfolio, I’m only interested in standout opportunities. If there are a number of companies that are not growing but they are trading at an irrationally low multiple, although a basket of these stocks may do well, I'm not buying and banking on the market eventually catching on. I need a catalyst.

Likewise, if another opportunity lacks an identifiable catalyst, I must either have strong conviction in its future growth—with a valuation that isn’t overly demanding—or, if growth is absent, the valuation must be so low that the yield from excess cash alone (ideally used for buybacks) provides more than sufficient returns.

Ultimately the preference is to have opportunity in both drivers.

Investment Framework in Practice

Let’s now apply the framework to the ideas I’ve shared to date. This section provides a high-level summary—links are included if you'd like to explore each post in more detail.

The below table is a summary of the conclusions drawn in this overview.

eDreams Odigeo SA, EDR.MC

Earnings Growth:

Cash EBITDA grew 49% in FY25 and they guide to at least 19% growth in FY26. Their FCF measure grew 123% in FY25 and they are guiding to at least 20% growth in FY26.

Their business model produces high ROIC with help from the deferred revenue that comes from Prime fees. As detailed in my post “An Introduction to eDreams” their TAM is significant and they are expecting to increase their prime members by >37% over the next 3 years. There appears to be a limiting factor in their reinvestment rate, certainly they want to ensure they maintain an appropriate LTV:CAC. With a high ROIC and their ability to reinvest limited, eDreams produces excess cash.

Excess Cash:

In FY25 eDreams spent €79.9m in buybacks and so far they have announced a further buyback of €20m in FY26. This is exactly what we want to see when the stock is at a low multiple.

Multiple:

On a FCF basis eDreams is trading at less than 8.3xFY26 FCF. On a Cash EBITDA basis eDreams is trading at ~6xFY26 Cash EBITDA. Clearly there is opportunity for an increase in multiple considering the quality of eDreams and its growth potential. Disappointingly, presently there is no clear catalyst to cause a change in sentiment.

Conclusion:

eDreams satisfies the Quality/Execution driver in my framework. eDreams is growing earnings at ~20% this year and if they return a similar amount of excess cash in buybacks as they did in FY25 this will produce a further ~8% return.

There is no clear catalyst to cause the low multiple that eDreams is awarded to increase, so for now returns may come from continuing growth and buybacks alone. Pleasingly these returns should be more than satisfactory. Having said this, catalyst or not, the growth will likely be appreciated in the multiple at some point.

Previous posts:

eDreams FY25 Results and New Buyback Announced

Vistry Group PLC, VTY.L

Earnings Growth:

Vistry is targeting £800m operating profit in the medium term. It is unclear when £800m will be achieved but I wouldn’t be surprised if growth is double digits in coming years.

Due to their partnerships model Vistry does not need to tie up significant capital in a landbank and so they can achieve ROIC of 40% over time. With Vistry’s scale and a degree of barriers to entry in partnerships there is reason to believe that they will be able to maintain their ROIC.

Although there is demand and opportunity for growth in the partnerships business, their reinvestment rate will be limited by things like finding the necessary partners and labour and so there will be excess cash.

Excess Cash:

Excess cash is currently being used to repurchase shares and decrease debt. At the current rate they will buy back roughly 3% of the company annually. There is hope that the scale of their buybacks will increase in the future once they have deleveraged and their business grows.

Multiple:

Vistry is trading along the lines of 6x operating profit, suggesting there is opportunity for a multiple increase. The catalyst to improve sentiment is their transformation to a growing, high ROIC partnerships business. Once they have proven their transformation, Vistry is unlikely to be trading at such a low multiple.

Conclusion:

Vistry checks all the boxes in my framework. Vistry is transforming to a high ROIC business which should exhibit significant growth whilst producing excess cash for buybacks. With a low multiple there is potential for a re-rating once it is acknowledged that their conversion to a partnerships business is a success.

If management do not execute, due to the low valuation a shareholder should not lose money. If for some reason the transformation is not acknowledged by an increase in valuation multiple the shareholder will still get +10% returns from growth and +3% returns from the excess cash generated.

Previous posts:

Vistry Group: A Rare Blend of Quality, Growth, and Deep Value?

International Workplace Group PLC, IWG.L

Earnings Growth:

IWG achieved $501m EBITDA in 2024 (adjusted from $557m previously reported as they have recently transitioned to US GAAP) and they are aiming for $1b in the medium term. I expect they will grow EBITDA along the lines of high single digits, possibly a little more. FCF should grow faster as they are going from a capital-intensive, company-owned model to focusing on a capital-light managed and franchised model.

Transforming to a capital-light model means their ROIC is trending upwards. Everything suggests there TAM will grow over time as flexible working is only expected to take more of the market.

They are growing their managed and franchised locations fast but there is a reinvestment rate limit as they need the necessary partners and need to ensure quality of service to all. As a result they are generating excess cash.

Excess Cash:

IWG is currently using their excess cash to buy back shares and pay a modest dividend. They have recently announced buybacks of up to $100m and they suggest they may announce more in the second half of this year. $100m at current price is 3.4% of the company, add the dividend yield and future buybacks and we could be looking at >4% yield from excess cash.

Multiple:

IWG currently trades around 6.5xEBITDA, which is low for a growing, dominant business. In my previous post I state “IWG's capital-light model invites comparison with asset-light hotel companies like Marriott and Hilton, which trade at meaningfully higher multiples—a valuation gap that could narrow as the market reassesses IWG”. So the main catalyst is the transformation being recognised.

But there is another potential catalyst. IWG has just recently transitioned to US GAAP as it “better reflects the financial profile of the business”. The CEO says a US listing is under consideration — this could result in IWG being awarded a higher multiple.

Conclusion:

IWG checks all the boxes in my framework. There is significant opportunity for growth and they are growing in a capital-light manner and so there is excess cash that is being used for buybacks. The multiple is low, but their capital-light division should start contributing to earnings this year and this will likely be appreciated in the multiple over time. There is also the possibility of a US listing which may improve the multiple.

Previous posts:

International Workplace Group: Moving towards a Capital Light Model

Wrapping Up

So there you have it, my framework and how my Exceptional Value Stock ideas to-date satisfy my framework.

If you have ideas that fit well with this framework, I welcome hearing about them. Again, if you think my framework is missing something, I’d love to hear your thoughts. Finally, if there is any aspect you would like me to dig in deeper on, let me know. Comment below.

Disclaimer: The information provided in this article/post is for informational purposes only and should not be considered financial or investment advice. I am not a licensed financial advisor. All investments carry risk, and you should do your own research before making any investment decisions. I may hold positions in the stocks discussed and may buy or sell them at any time.