Jet2 (JET2.L, £16.21): Value Hiding in Plane Sight

A tour operator trading at airline multiples — with buybacks just taking off.

An introduction to Jet2. As usual I could have gone into greater detail but for now I have kept the thesis to the main points. Let me know if there is anything you would like expanding on.

Summary

Jet2 is the UK’s largest tour operator. Over the past 18 years, it has transformed from a low-cost airline into a vertically integrated package holiday provider. Thanks to a strong brand and customer loyalty, the business has achieved consistent growth and now leads the market. Despite this transformation, the market still values Jet2 like an airline. Shares currently trade at a significant discount to historical multiples, even as the company initiates its first share buybacks. With continued growth and appropriate capital allocation, Jet2 could continue to deliver >20% annualised returns, as it has done for many years.

Business Overview

Jet2 is a high-growth, market-leading package holiday business with an airline attached—but it’s valued as if it were just an airline. The market currently applies a P/E ratio of ~7.8x, or ~7.2x when accounting for excess cash.

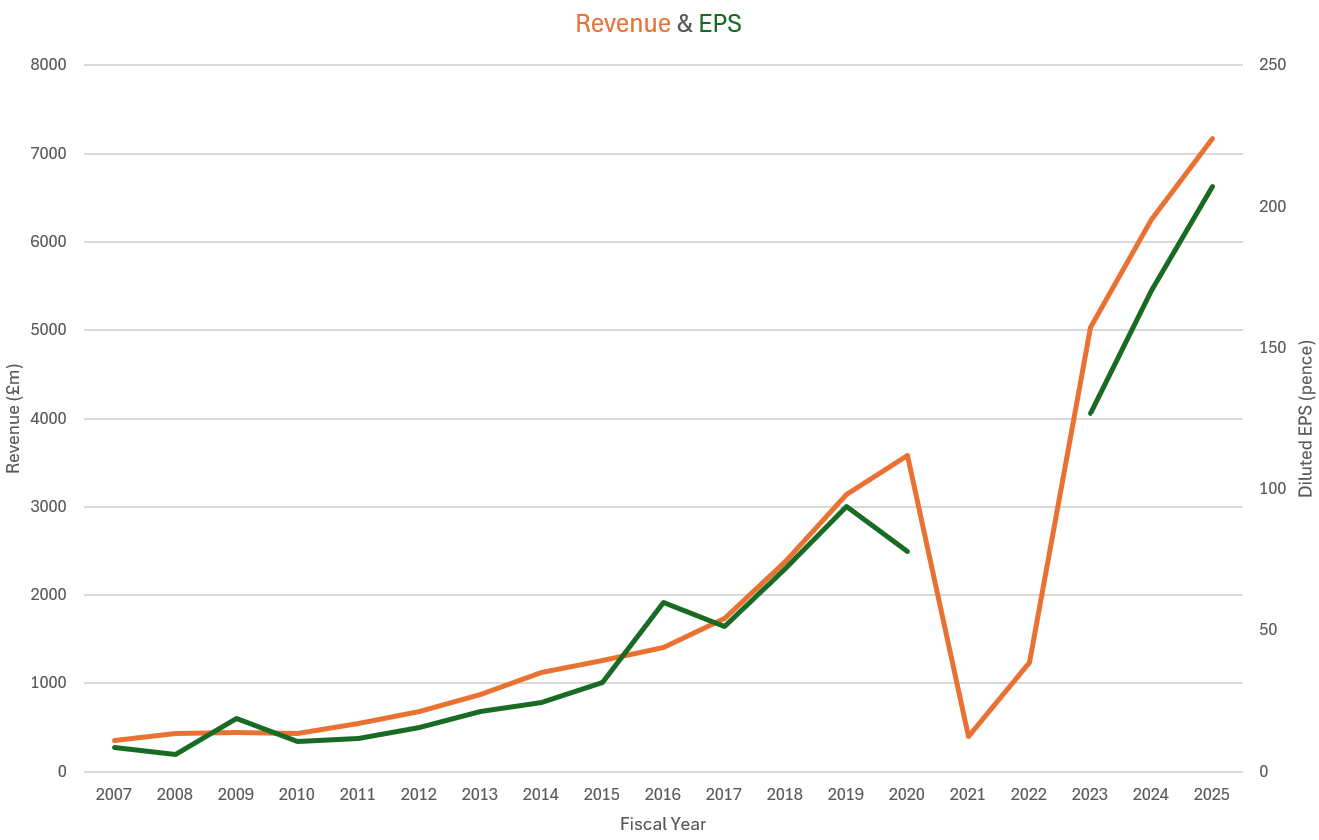

Since FY2010, the share of Jet2’s passengers coming from package holidays has risen from 2% to 67%. Today, over 80% of its revenue comes from its holiday business. Revenue and EPS have each grown >20% annually over this period, and the stock has compounded at a similar rate. A single-digit P/E is too low for such performance.

Airlines typically deserve a low multiple due to heavy capital requirements, high fixed costs, price sensitivity, and exposure to macro shocks. Their product is a commodity. In contrast, package holiday operators enjoy greater pricing power, customer loyalty, and more stable forward bookings with advance payments—especially when backed by a trusted brand. Jet2 benefits from these advantages. As shown above, barring COVID when many companies were completely shut down, they have achieved very consistent growth.

Business Model Evolution

Jet2 launched its package holiday business in February 2007, pivoting from its prior focus on flights and logistics (the latter it has since exited). Today, over 80% of revenue and 67% of passengers come from the holiday segment.

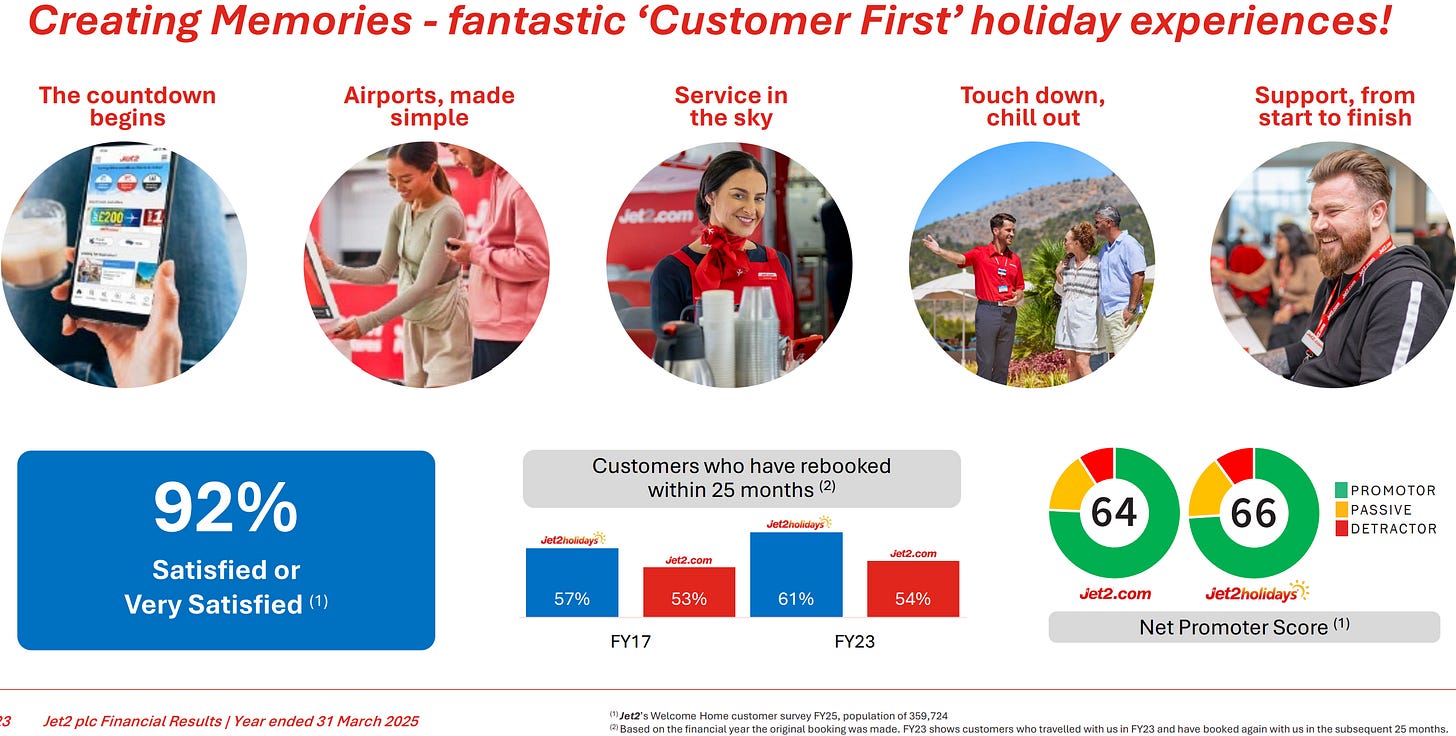

Operating its own airline provides Jet2 with end-to-end control of the customer experience, from pricing and scheduling to customer service. This integration underpins its strong service reputation and drives repeat business.

An example is Jet2holidays’ Resort Flight Check-In service. Customers can check their baggage in for the return flight at the hotel and enjoy their final day bag-free. Jet2 states it is the only holiday operator in Europe to provide this service as it can leverage its direct control over both airline baggage handling and in-resort operations.

Jet2 continues to offer flight only services ensuring capacity utilisation. These customers are an additional marketing opportunity for the core holiday product.

Jet2’s customer-centric model has won it numerous awards and increased its holiday market share to ~21%, making it the UK’s largest tour operator.

Reinvestment Rate and Capital Allocation

At the end of FY2025, Jet2 reported £3,155.8m in gross cash. Of this, £2,058.9m represents customer advance payments. Netting this out, the company holds £1,096.9m in “own cash”.

Management targets a cash buffer of £600-£700m to weather shocks—suggesting around £400m in excess cash today. In April 2025, Jet2 announced a £250m buyback, with half executed by end of July and the remainder expected over the next six months—an appropriate use of capital given the low valuation. This equates to a ~3.7% shareholder yield in six months.

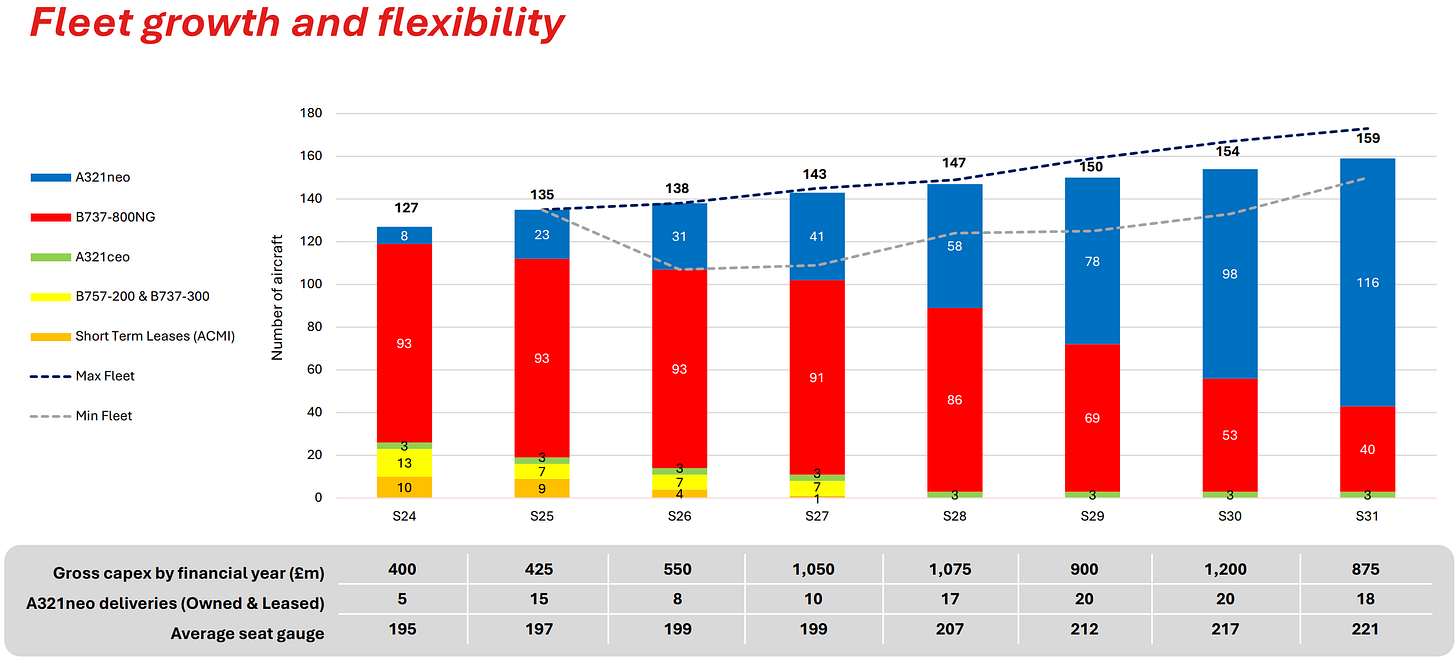

Historically, Jet2 has not executed buybacks. This new buyback program may suggest diminishing reinvestment opportunities ahead. 85% of the UK population is now within a 90-minute drive of Jet2's bases, the company commands a 21% market share, and Jet2 is planning more modest fleet growth than in the past. These factors collectively suggest that future growth may moderate from historical levels.

Still, even if EPS growth slows to low double digits or even high single digits, deploying excess capital via buybacks at depressed valuations should enhance per-share returns. Once the current buyback is completed, further programmes are likely.

Multiple

Despite Jet2 consistently delivering growth through macro headwinds—including austerity, Brexit, and the cost of living crisis—and generating over 20% annualised returns in the long term, the stock remains volatile and highly sensitive to macroeconomic news. During market downturns, the P/E can fall to mid-single digits; in bullish conditions, it has traded at mid-teens. Today’s P/E in the low 7s offers upside potential of 2-3 turns merely to reach its long-term average.

There is no clear near-term catalyst to unlock this value. But patient investors may be rewarded as sentiment normalises.

Margin of Safety

Please see my post here on my investment framework and what drives returns. Using this framework I will now briefly summarise the potential upside in Jet2.

Multiple Re-Rating: Based on Jet2’s business quality and long-term performance, a mid-teens P/E is justifiable. Even a partial re-rating to Jet2’s long-term average could yield a 25% return.

Earnings Growth: While past earnings growth exceeded 20% annually, future growth may moderate to low double digits or slightly below.

Excess Cash: With ~£400m in excess cash, Jet2 is actively buying back shares. Capex requirements remain manageable, and future cash generation should support continued capital returns.

Together, these factors suggest Jet2 could continue to deliver >20% annualised returns over the next 3 years. If the multiple decreases temporarily due to macro concerns it will be an opportunity to add, and then any buybacks will provide an even greater contribution to long-term returns.

Risks & Mitigants

While macro and geopolitical events will always impact travel, Jet2 has a long track record of navigating these cycles. Instead, the real risk is execution and protecting the brand. CEO Steve Heapy has led the package holiday business since 2009, delivering consistent growth and operational excellence so the business is in trustworthy hands.

In recent years, Jet2 has placed substantial orders for Airbus A321neos to both replace its existing fleet and expand capacity. While there is execution risk associated with these orders, the management team is experienced. Although this is a larger commitment than previous ones, it is not Jet2’s first major aircraft order cycle.

The UK market opportunity may eventually mature. International expansion into Europe where the Jet2 brand is not as strong is a possibility but may not pay off. Alternatively, Jet2 may focus on returning more capital to shareholders.

Catalysts (or Lack Thereof)

The company has undergone a long-term transformation into a leading holiday operator, yet valuation remains tethered to airline multiples. There is no immediate catalyst to drive a re-rating.

That said, recent shareholder-friendly moves are encouraging: initiating buybacks and hosting there first earnings audiocast.

A potential catalyst would be moving from AIM to the LSE main market and joining the FTSE 250, potentially broadening the investor base. However, I am not aware of any plans to do so.

Conclusion

Jet2 is a high-quality, market-leading holiday business with a strong brand, great management and an impressive track record of growth. The business has evolved, but the market still prices it like an airline. While near-term catalysts are lacking, patient investors have an opportunity to buy a growing, cash-generating company at a discount.

With a low multiple, buybacks, and growth, Jet2 could continue to generate exceptional returns.

If you think I am missing something let me know. If would like me to focus on a particular aspect in a future update, please comment. Thanks.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or investment advice. I am not a licensed financial advisor. All investments carry risk, and you should conduct your own research before making any investment decisions. I may hold positions in the stocks discussed and may buy or sell them at any time.