eDreams FY25 Results and New Buyback Announced

eDreams Hits €100m FCF, Grows Prime Members 25%, Growing FCF >20% this Year – Is This Still a €1B Business?

Summary

eDreams just delivered a strong FY25, hitting or beating every key target — and the market still values it at less than 8.3x next year’s cash flow. With 25% Prime membership growth, strong guidance, and another buyback, eDreams looks increasingly like a scalable subscription business — not just another online travel agent.

FY25 Results

eDreams announced their FY25 results today. Here is the headline:

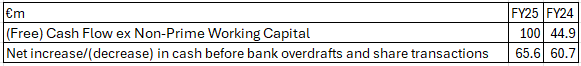

“eDO meets its €180 million Cash EBITDA target (€180.4 million reported); Prime members – 7.25 million (7.26 million reported); and exceeded by 11% the generation of (Free) Cash Flow ex Non-Prime Working Capital of over €90 million (€100.0 million reported), which more than doubled vs. FY24 (€44.9 million).”

Understanding their “(Free) Cash Flow ex Non-Prime Working Capital”

So, not only did they meet their targets they beat on their free cash flow alternative performance measure (FCF APM). It is worth looking into their FCF APM and consider whether it is appropriate. Below is their full definition:

“(Free) Cash Flow ex Non-Prime Working Capital means Cash EBITDA and adjusted for cash flows from investing activities, tax payments and interest payments (normalised interest payments, excluding one-offs linked to refinancing). The Group believes this measure is useful as it provides a simplified overview of the cash generated by the Group from activities needed to conduct business and mainly before equity / debt issuance and repayments. This measure does not include changes in working capital other than the variation of the Prime deferred liability as management believes it may reflect cash that is temporary and not necessarily associated with core operations”

As you can see it starts with Cash EBITDA. I talked about Cash EBITDA in my “Introduction to eDreams” post which you can find here. I am always sceptical of businesses APMs but Cash EBITDA rightly considers the “variation of deferred revenue”. And so eDreams FCF APM also considers this deferred revenue but ignores other changes in working capital. They ignore other changes to working capital as they do not believe it is reflective of the success of their subscription business model. Certain working capital changes are outside of their control. It is worth comparing their FCF APM to how much cash the business generates as shown by their cash flow statements. Here are the figures for the last 2 years:

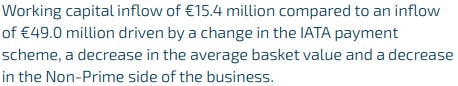

In part the difference between the two figures for FY25 is explained by inflows from working capital. Although Prime deferred revenue increased €46.8m, on the cash flow statement there was only a €15.4m inflow in working capital. This compares to FY24 having a €33.6m increase in Prime deferred revenue and on the cash flow statement there was an inflow of €49m in working capital. So what happened to working capital this year:

All these reasons for the decrease are not concerning. The decrease in the non-Prime side of the business is intentional and desired as they become more and more a subscription business. The decrease in the average basket value isn’t concerning as ultimately eDreams is a subscription business and so the concern is membership fees not basket fees. The change to the IATA payment scheme (which affects when agents like eDreams pay airlines) is outside of their control. So overall I am not concerned, but I will continue to compare their FCF APM to actual cash flow to ensure this isn’t a continuous trend.

Prime Growth

Prime members grew 25% for the year

And they are continuing to guide to over 13.7% growth in prime members next year and over 10% the 2 years after.

Earnings Guidance and Buybacks

They are also still guiding to €215-€220 Cash EBITDA and >€120 “(Free) Cash Flow ex Non-Prime Working Capital for FY26. This implies a double digit FCF yield and so buybacks are a priority for them. They have announced a further €20m buyback. They spent €79.9m buying backs shares in FY25 and are currently coming to the end of their current €50m buyback. To put this all in context their market cap is currently ~€960m.

Valuation

Management in the below slide suggests that eDreams should have more like a 5% yield which would imply a stock price >€20 by May 2026. In my previous post when the stock was €7.28 I said the following “if the company continues to perform it is possible the stock triples in the next few years and could still be considered inexpensive thus providing a significant margin of safety”.

Conclusion

With <120m shares outstanding they are guiding to generate >€120m in (Free) Cash Flow ex Non-Prime Working Capital over the next 12 months and have generated €100m in the last 12 months. So with the stock at €8.31 they are trading at <10x LTM FCF and <8.3x NTM FCF. eDreams continues to have the rare combination of quality, growth and significant value making it a potentially exceptional opportunity.

The eDreams results can be found here.

Enjoyed this read. Really like the opportunity too. Do you think 2%/ €18M share dilution trough SBC is excessive? Do you know if it is adjusted for in the the “Cash Ebitda” metric.